For many homeowners, a HELOC offers flexibility that traditional loans simply don’t, but only if you understand how borrowing limits and payments really work. With the right planning and tools, you can make confident decisions about tapping into your home’s equity without surprises.

That’s exactly where a HELOC calculator helps.

Our free HELOC calculator is designed to give you realistic estimates of your home equity credit limit, interest-only payments, repayment payments, and long-term costs, all in one place. This guide explains how a HELOC works, how payments are calculated, and how to use a calculator to make better borrowing decisions.

What Is a HELOC and How Does It Work?

A Home Equity Line of Credit (HELOC) is a revolving line of credit secured by your home. Instead of receiving a lump sum (like a home equity loan), you get access to a credit limit that you can borrow from as needed.

Key features of a HELOC:

- Works like a credit card backed by your home

- Interest is charged only on the amount you use

- Typically has variable interest rates

- Comes with two phases: a draw period and a repayment period

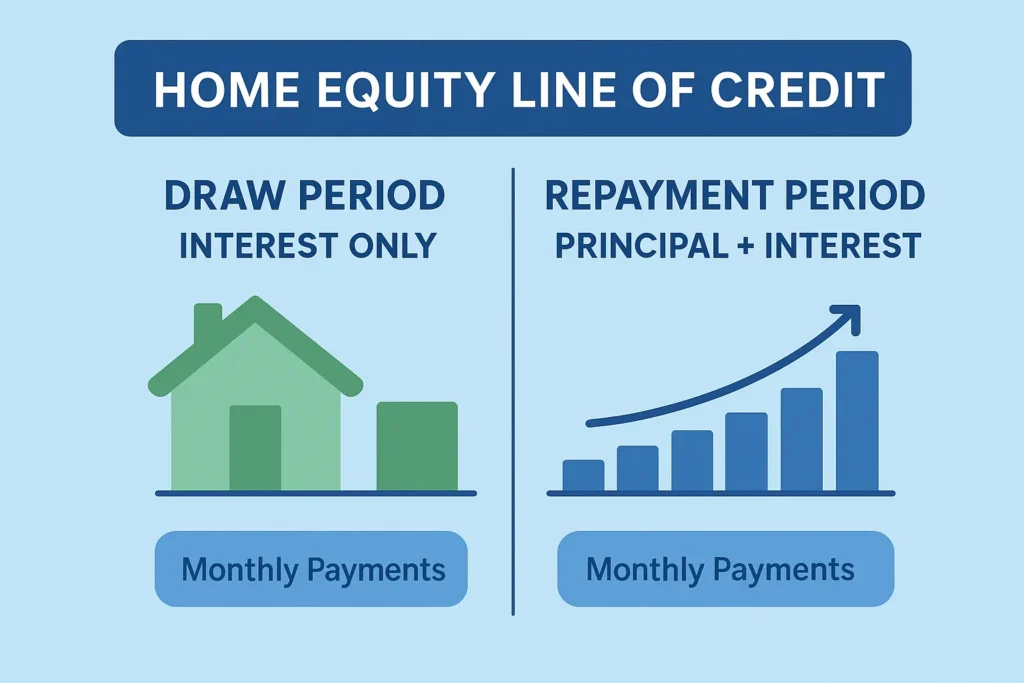

Draw Period

During the draw period (often 5–10 years), you can:

- Borrow money

- Repay and borrow again

- Usually make interest-only payments

Repayment Period

After the draw period ends:

- You can no longer borrow

- You must repay principal + interest

- Monthly payments usually increase

This structure makes HELOCs flexible, but also more complex than traditional loans, which is why using a home equity line of credit payment calculator is so important.

Current HELOC Interest Rates: What to Expect Today

HELOC interest rates are not fixed and can change over time based on broader market conditions. Most HELOCs use variable interest rates, which means your rate is typically tied to the U.S. prime rate, plus or minus a lender’s margin.

HELOC rates typically fall within a broad range, but the exact rate you qualify for depends on factors such as your credit profile, lender policies, and market conditions at the time of application. Since rates can change, it’s best to treat any calculation as an estimate rather than a guaranteed figure.

- Your credit score and credit history

- Your loan-to-value (LTV) ratio

- Your debt-to-income ratio

- The lender’s pricing and risk policies

- Overall interest rate trends in the market

Because rates fluctuate, two homeowners applying at the same time may receive very different offers. That’s why it’s important to view any HELOC calculation as an estimate, not a guaranteed rate.

Our HELOC calculator lets you adjust the interest rate so you can see how different rate scenarios affect your monthly payment, helping you plan more realistically before speaking with a lender.

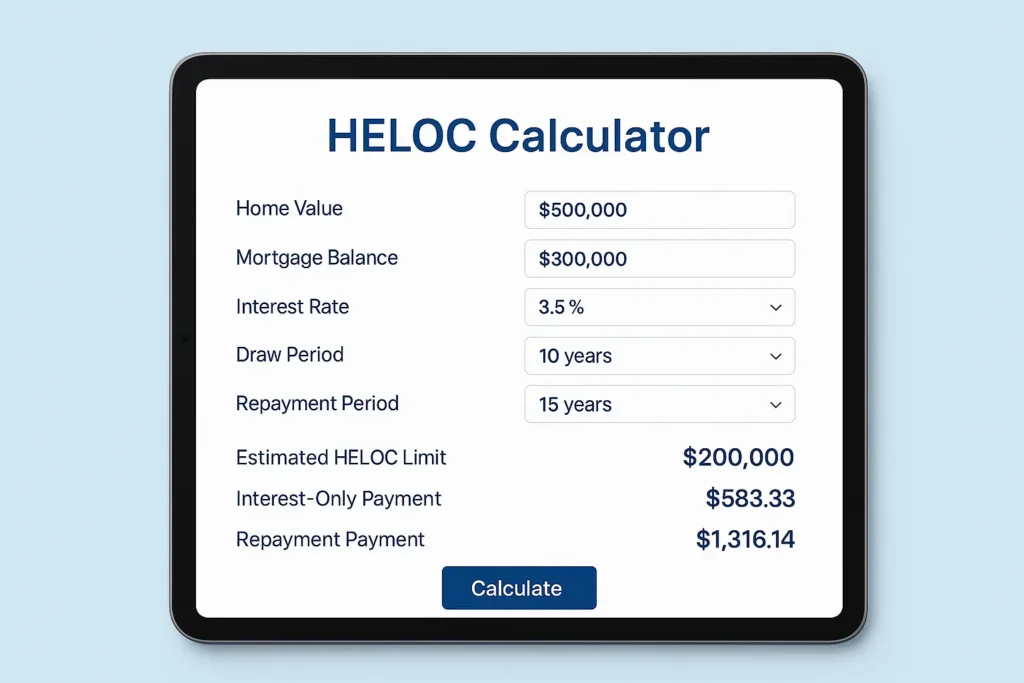

How Our Free HELOC Calculator Works

Our home equity line of credit calculator estimates your borrowing power and payments using the same logic most lenders follow.

Information You Need to Enter

To get accurate results, the calculator asks for:

- Current home value

- Outstanding mortgage balance

- Expected HELOC interest rate

- Draw period length

- Repayment period length

These inputs allow the equity calculator to estimate your available equity and monthly payment scenarios.

What the HELOC Calculator Shows You

Once you enter your details, the calculator provides:

- Estimated HELOC credit limit

- Interest-only monthly payment (draw period)

- Fully amortized payment (repayment period)

- Approximate total interest cost

This makes it both a HELOC payment calculator and a HELOC estimator, helping you plan short-term and long-term affordability.

How to Calculate HELOC Payments (With a Real Example)

Understanding how HELOC payments work is easier with a real-world example.

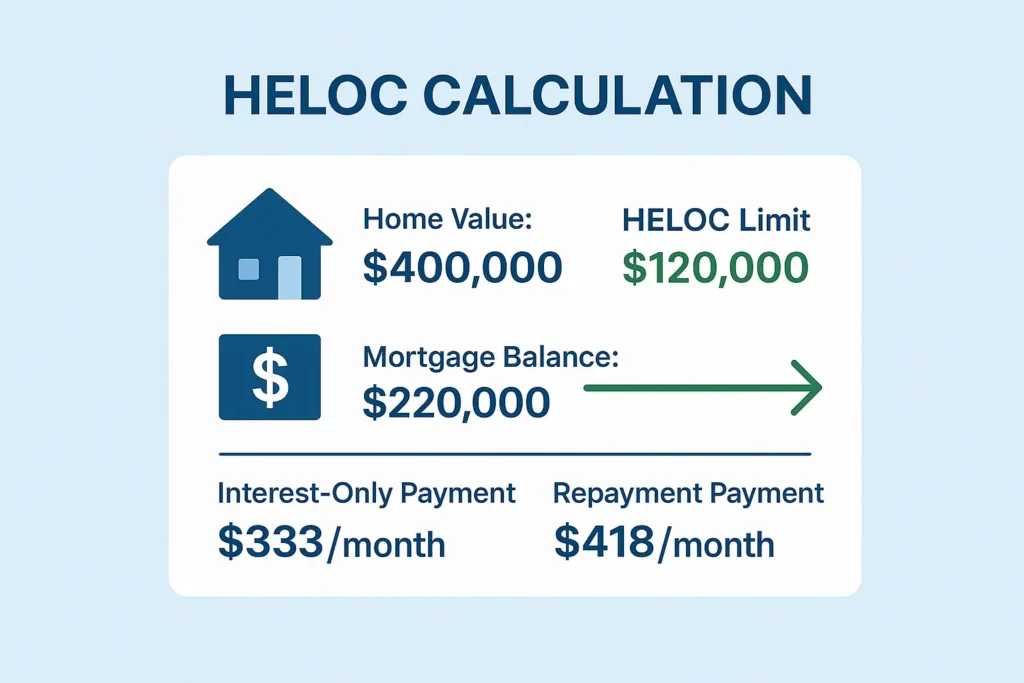

Example Scenario

- Home value: $400,000

- Mortgage balance: $220,000

- Maximum lender LTV: 85%

- HELOC interest rate: 8%

- Draw period: 10 years

- Repayment period: 20 years

Step 1: Calculate Available Equity

85% of $400,000 = $340,000

$340,000 − $220,000 = $120,000 available HELOC limit

Step 2: Interest-Only Payment (Draw Period)

If you borrow $50,000 at 8% interest:

Monthly interest =

$50,000 × 8% ÷ 12 = $333 per month

This is what an interest-only HELOC calculator shows during the draw phase.

Step 3: Repayment Payment

Once repayment starts, the $50,000 is amortized over 20 years:

Estimated payment = $418 per month

This demonstrates why payments often increase after the draw period ends, something many homeowners underestimate.

HELOC Payment Calculator vs HELOC Payoff Calculator

Not all calculators serve the same purpose.

HELOC Payment Calculator

- Estimates monthly payments

- Helps with affordability

- Useful before applying

HELOC Payoff Calculator

- Estimates how long it takes to pay off

- Shows interest savings from extra payments

- Useful after borrowing

Both tools are helpful, but if you’re still deciding whether to borrow, a HELOC payment calculator free tool is the best starting point.

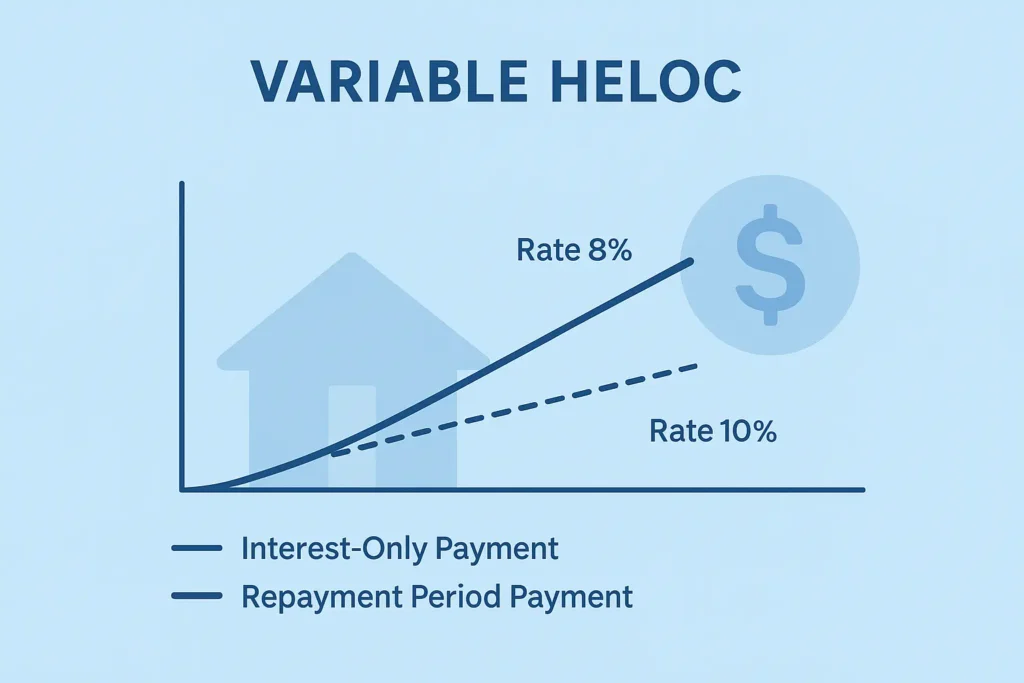

Understanding Variable HELOC Rates and Payment Risk

Most HELOCs come with variable interest rates, which means your rate, and your monthly payment, can change over time. Understanding how this works is critical before borrowing.

What Is the Prime Rate?

HELOC rates are usually tied to the U.S. prime rate, a benchmark interest rate that moves up or down based on decisions by the Federal Reserve. Lenders typically charge:

Prime rate + a lender margin

When the prime rate increases, your HELOC rate usually increases as well. When it falls, your rate may decrease.

How Rate Changes Affect Your Monthly Payment

Because HELOC rates are variable, even a small rate increase can noticeably raise your monthly payment, especially once you’re repaying both principal and interest.

Example Scenarios:

- If you have a $50,000 HELOC balance at 8%, your interest-only payment is about $333 per month.

- If the rate rises to 10%, that same balance would cost about $417 per month in interest alone.

That’s an increase of $84 per month, without borrowing any additional money.

During the repayment period, rate increases can have an even bigger impact because you’re paying back both principal and interest.

Why This Matters

Many homeowners focus only on today’s payment and underestimate how much payments can rise over time. This is often referred to as payment shock, when monthly payments increase due to higher rates or the transition from interest-only to full repayment.

Our HELOC calculator helps you prepare for this by letting you test different interest rate scenarios, so you can see how future rate changes might affect your budget before you commit to borrowing.

Interest-Only HELOC vs Amortizing Payments

Understanding this difference is critical.

Interest-Only HELOC Calculator

During the draw period:

- Lower monthly payments

- No principal reduction

- Balance stays the same unless you pay extra

Risk: Payments can jump significantly later.

HELOC Amortization Calculator

During repayment:

- Principal + interest included

- Balance decreases monthly

- Predictable payoff timeline

Using a HELOC amortization calculator helps you see the long-term cost and avoid payment shock.

Fixed-Rate HELOC Option: More Predictable Payments

While most HELOCs have variable interest rates, some lenders offer a fixed-rate HELOC option. This feature allows you to convert part, or sometimes all, of your outstanding HELOC balance into a fixed-rate loan segment.

With a fixed-rate option:

- Your interest rate stays the same

- Your monthly payment becomes predictable

- You’re protected from future rate increases

Many homeowners use this option after drawing funds, especially if they plan to carry a balance for several years and want more stability.

It’s important to note that fixed-rate HELOC segments may come with different terms or fees, and not all lenders offer them. If payment certainty is important to you, this is a feature worth asking about when comparing lenders.

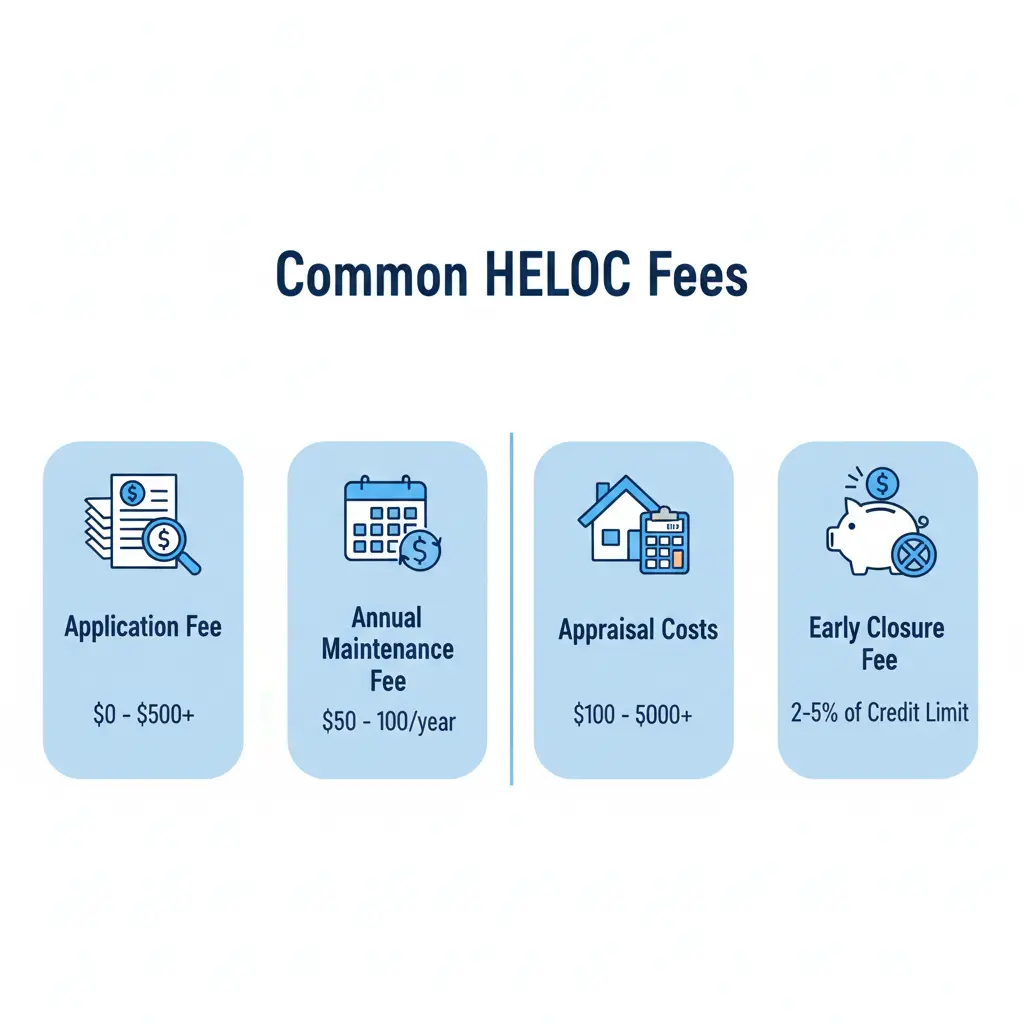

HELOC Fees and Closing Costs to Consider

When using a HELOC, interest isn’t the only cost to think about. While many lenders advertise low rates, fees and closing costs can vary widely, and they directly affect how much a HELOC truly costs over time.

Here are the most common HELOC fees you may encounter:

Application or Origination Fees

Some lenders charge an upfront fee to process and set up your HELOC. Others may waive this cost, especially during promotional periods.

Annual Maintenance Fees

Certain HELOCs include a yearly fee to keep the account open, even if you don’t actively use the line.

Appraisal Costs

Because a HELOC is secured by your home, lenders often require an appraisal to confirm its value. This cost may be paid out of pocket or rolled into the loan.

Early Closure or Cancellation Fees

Some lenders charge a penalty if you close your HELOC within a short time frame (often within the first 1–3 years). This helps lenders recover upfront costs if the line is closed early.

Not every HELOC includes all of these fees, and some lenders offer low-fee or no-fee options. That’s why it’s important to compare offers carefully and ask lenders for a full fee breakdown before committing.

How Much Can You Borrow With a Home Equity Line of Credit?

Lenders usually cap borrowing based on loan-to-value (LTV) ratios.

Typical Limits

- Most lenders allow 80%–85%-90% LTV

- Strong credit may unlock higher limits

- Income and debt also matter

Other Factors That Affect Borrowing

- Credit score (usually 620+)

- Debt-to-income ratio

- Employment stability

A home equity line payment calculator helps estimate borrowing power, but final approval depends on the lender.

HELOC Calculator vs Other Line of Credit Calculators

A HELOC is just one type of credit line.

HELOC vs Personal Line of Credit

- HELOC: Lower rates, secured by home

- Personal LOC: Higher rates, unsecured

HELOC vs Credit Cards

- HELOC: Lower interest, longer terms

- Credit cards: Convenience, higher cost

That’s why a line of credit payment calculator specifically designed for HELOCs gives more accurate results than generic tools.

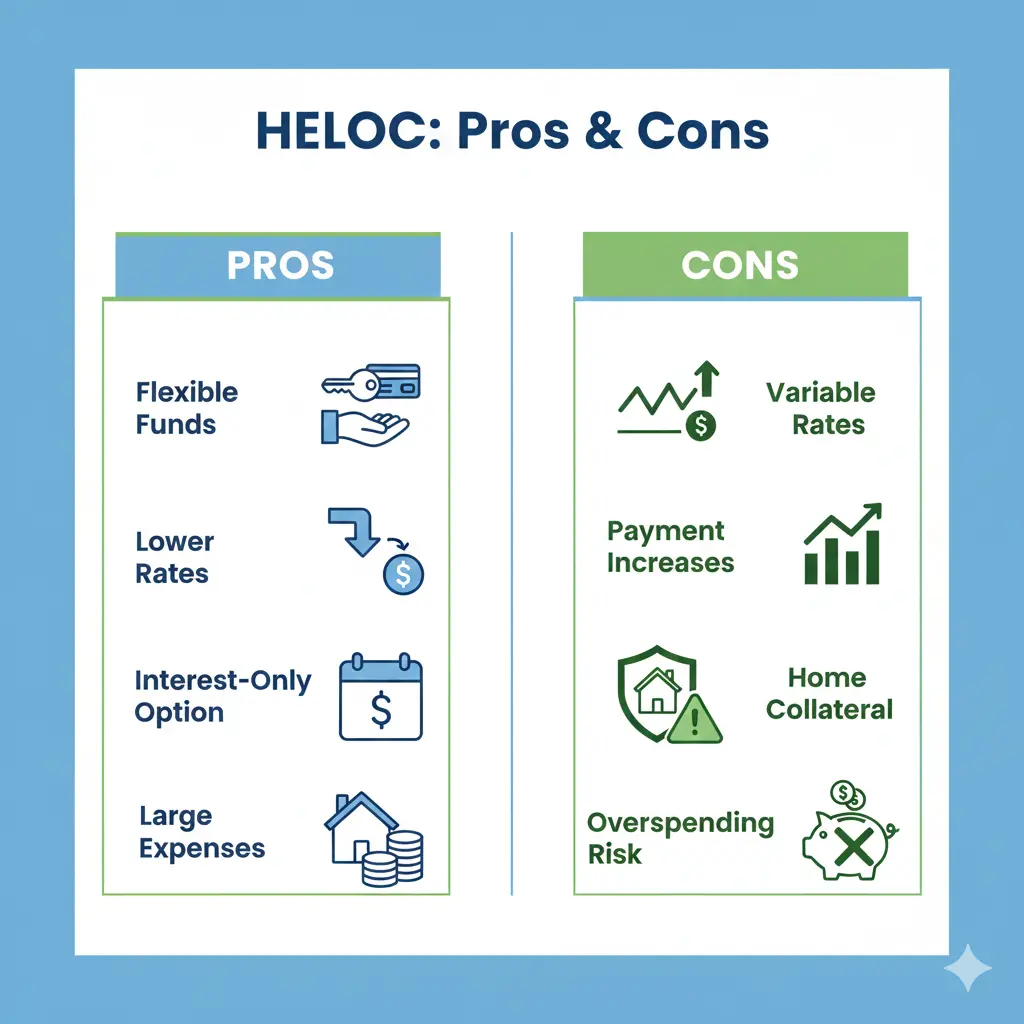

Pros and Cons of Using a HELOC

Pros

- Flexible access to funds

- Lower rates than most unsecured debt

- Interest-only payment option

- Useful for large, planned expenses

Cons

- Variable interest rates

- Payments can increase

- Home is collateral

- Temptation to overspend

Because your home secures the line, HELOCs should be treated as long-term financial commitments, not short-term spending tools.

When a HELOC Makes Sense (And When It Doesn’t)

HELOC May Be a Good Option If:

- You’re renovating your home

- You need funds for education

- You want flexible access over time

HELOC May Not Be Ideal If:

- You need a fixed payment

- You’re covering everyday expenses

- Your income is unstable

A calculator helps with numbers, but judgment matters just as much.

Frequently Asked Questions (FAQs)

Is a HELOC better than a home equity loan?

A HELOC offers flexibility, while a home equity loan calculator offers fixed payments. The better option depends on your needs.

Is HELOC Interest Tax Deductible?

In some cases, HELOC interest may be tax-deductible, but it depends on how the money is used.

Under current U.S. tax rules, HELOC interest is generally deductible only if the funds are used to buy, build, or substantially improve the home that secures the loan. Using HELOC funds for personal expenses such as travel, debt consolidation, or everyday spending typically does not qualify for a deduction.

Tax laws and individual situations can vary, so it’s always a good idea to consult a qualified tax advisor to understand how a HELOC may affect your taxes.

Can HELOC payments increase?

Yes. Because most HELOCs have variable rates, payments can rise over time.

What happens after the draw period ends?

You enter repayment and must pay both principal and interest.

Can I pay off a HELOC early?

Yes. Many lenders allow early payoff without penalties.

Does a HELOC affect my credit score?

Yes. Like any credit account, it can help or hurt your score depending on how you manage it.

Use Our Free HELOC Payment Calculator

If you’re considering tapping into your home’s equity, our free HELOC calculator gives you clarity before you commit. It helps you:

- Estimate your credit limit

- Understand monthly payments

- Compare interest-only vs repayment costs

- Plan responsibly

Try different scenarios, adjust interest rates, and see how borrowing decisions affect your budget, all before speaking to a lender.

Why Use Our HELOC Calculator?

Our free HELOC calculator is designed to give you a clear, realistic view of your home equity borrowing options, and here’s why it stands out:

- Interest-Only + Repayment Comparison: See the difference between low draw-period payments and full repayment amounts.

- Long-Term Interest Estimation: Understand how much you’ll pay in total over the life of your HELOC.

- Easy Scenario Testing: Adjust interest rates, loan amounts, and periods to see how changes affect your monthly payments.

- No Signup Required: Get instant results without sharing personal info or creating an account.

With these features, our calculator helps you plan responsibly, avoid payment surprises, and make informed decisions, all in one easy-to-use tool.

Final Thought

A HELOC can be a powerful financial tool when used wisely. The key is understanding the numbers before you borrow. A reliable home equity line of credit calculator puts that knowledge in your hands.

Important: This calculator provides estimates for informational purposes only. Actual interest rates, credit limits, fees, and monthly payments may vary based on lender requirements, market conditions, and your financial profile. Calculator results do not represent a loan offer or approval.