Amortization Schedule Calculator

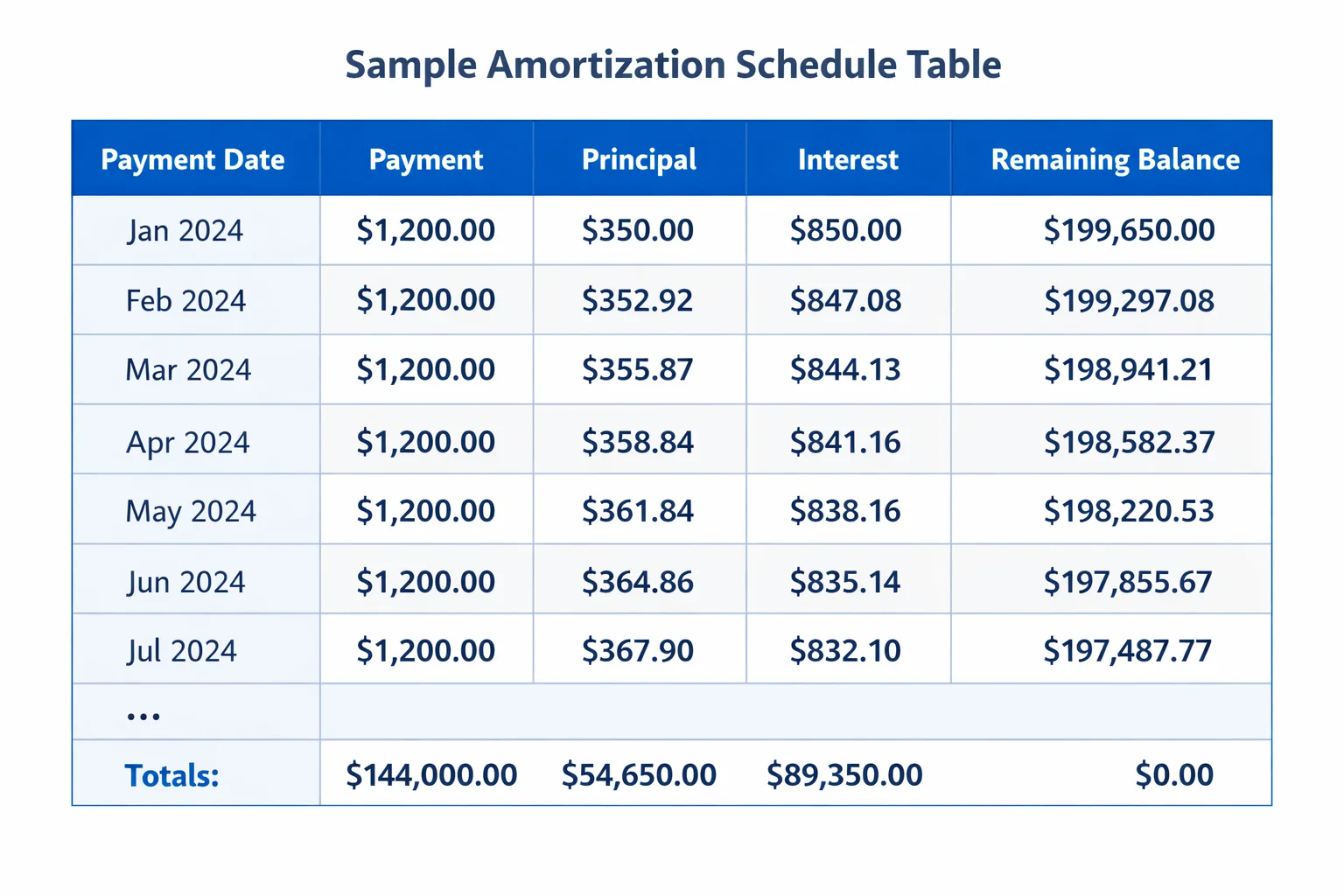

| Month | Payment | Principal | Interest | Balance |

|---|

Mortgage Calculators

Plan your mortgage, refinance, and home financing with our free calculators

Home Equity Loan Calculator

Estimate how much you can borrow using your home’s equity and calculate monthly payments easily.

HELOC Calculator

Estimate your Home Equity Line of Credit based on home value.

Loan-to-Value (LTV) Calculator

Calculate your loan-to-value ratio easily.

Mortgage Payment Calculator

Find your monthly mortgage payment instantly.

Cash-Out Refinance Calculator

See how much cash you can take out when refinancing.

DTI Calculator

Check your debt-to-income ratio before applying.

Home Affordability Calculator

Know how much home you can afford.

Extra Payment Mortgage Calculator

See how extra payments reduce loan time and interest.

Mortgage Refinance Calculator

Compare refinancing options and savings.

Amortization Schedule Calculator: Full Monthly Payment Breakdown

Looking to understand your loan payments in detail? Our Amortization Schedule Calculator is the easiest way to generate a full monthly payment schedule> for your mortgage, personal loan, or auto loan. Simply enter your loan amount, interest rate, and loan term to calculate your monthly payments, total interest, and remaining balance over the life of your loan.

Why Use Our Amortization Calculator?

- Free and Accurate: Quickly calculate your monthly payments without complicated formulas.

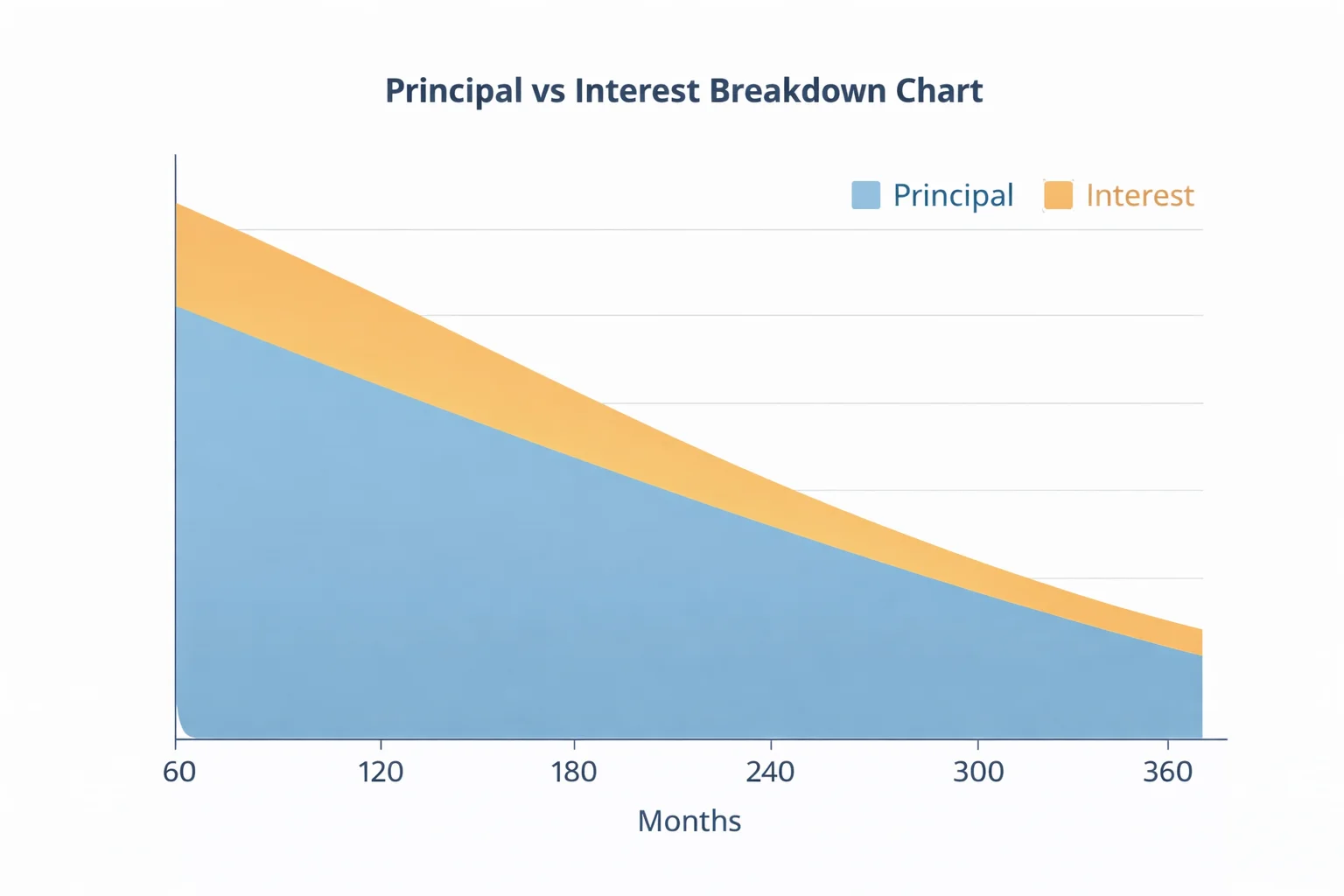

- Full Amortization Table: See a month-by-month breakdown of principal, interest, and remaining balance.

- Downloadable Schedule: Export your schedule as a PDF for your records or financial planning.

- Plan Your Payments: Understand how extra payments can reduce interest and shorten your loan term.

How Our Amortization Schedule Works

An amortization schedule shows how each loan payment is split between principal and interest. Early payments are mostly interest, while later payments reduce more of your principal. By reviewing your amortization schedule, you can track how much of your payment goes toward interest and principal each month. For a detailed mortgage payment breakdown, check our calculator.

Step-by-Step: Using the Calculator

- Enter your loan amount in dollars.

- Enter your annual interest rate (%).

- Enter your loan term in years.

- Click "Calculate" to generate your full amortization schedule.

- Use the "Read More" button to see the complete monthly schedule or download it as a PDF.

Benefits of Understanding Your Amortization Schedule

By using our amortization schedule calculator, you can plan your monthly budget effectively. This is especially useful for those seeking a home equity loan calculator to manage property debt. You can see exactly how much interest you'll pay and identify opportunities to pay off your loan faster by making extra payments.

FAQs – Amortization Schedule Explained

What is an amortization schedule?

An amortization schedule is a detailed table showing how your loan payments are applied over time to principal and interest. It helps you track your remaining balance.

Can I use this for any type of loan?

Yes, our loan amortization calculator works for mortgages, auto loans, personal loans, and other fixed-rate loans. It provides an accurate estimate of home equity payments instantly.

Is this calculator free?

Absolutely. Our amortization schedule calculator free tool is completely online with no signup required. You can generate and download your schedule instantly.

Start Planning Your Loan Today

Use our tool to gain a complete understanding of your loan payments. Calculate your monthly payments now and download your full amortization schedule for free!