Buying a home is one of the biggest financial decisions you’ll ever make. Understanding your mortgage payments, interest, and affordability can be overwhelming without the right tools. That’s where a mortgage calculator comes in. Whether you’re in the US or the UK, a free online mortgage calculator can help you plan better, compare options, and make informed decisions about your future home.

What is a Mortgage Payment Calculator?

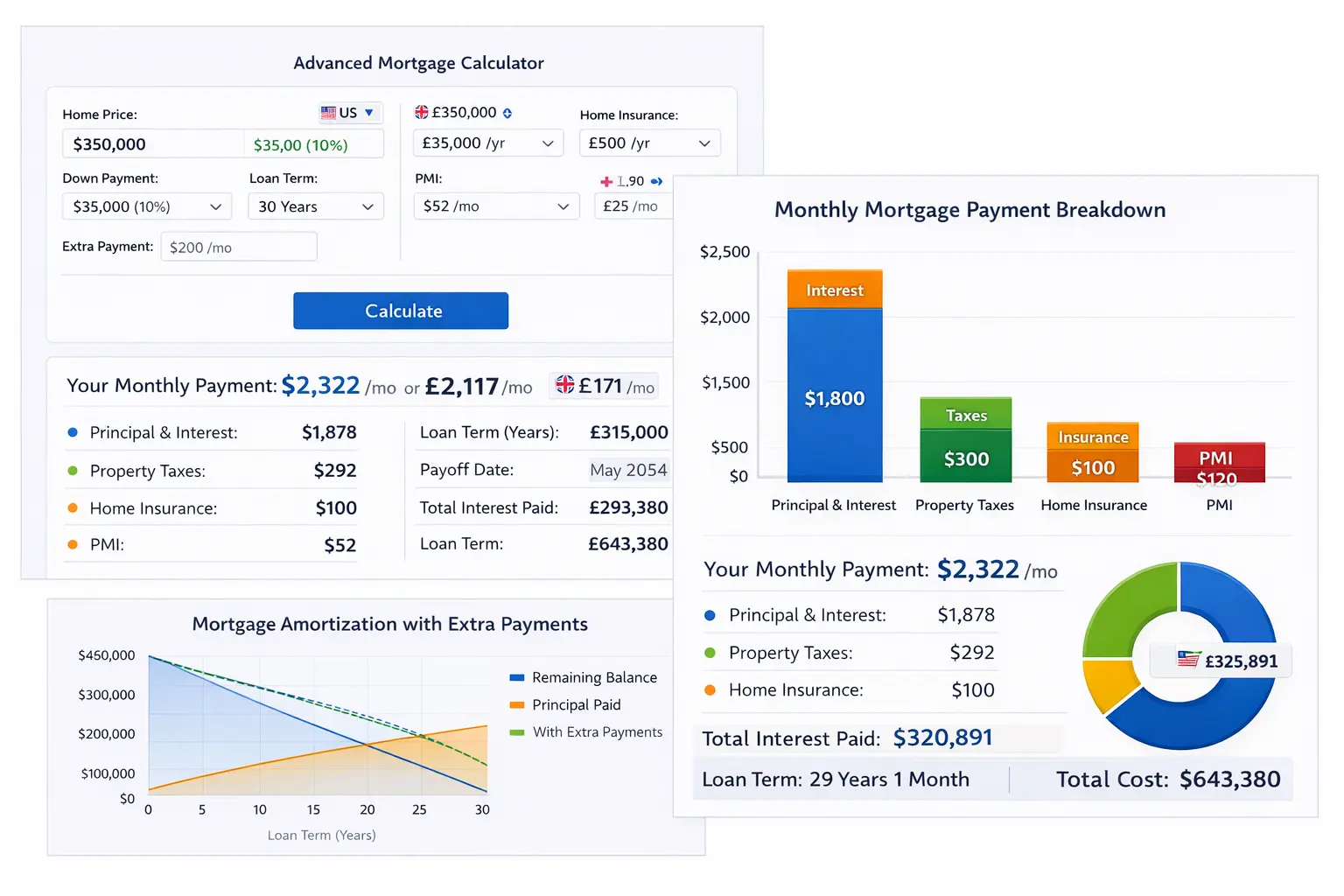

A mortgage payment calculator is an interactive tool that estimates your monthly mortgage payments based on your loan amount, interest rate, and loan term. Modern calculators also factor in extra payments, taxes, insurance, and private mortgage insurance (PMI) to give you a complete picture of your monthly obligations.

Key Benefits of Using a Mortgage Calculator:

- Calculate monthly payments accurately

- Understand the impact of interest rates and loan terms

- Plan for extra payments to pay off your mortgage faster

- Compare different mortgage options for the best fit

With a reliable online mortgage calculator, you don’t need to guess your monthly expenses. You can plan your budget confidently, whether you’re a first-time buyer or looking to remortgage.

How to Calculate Mortgage Payments

Understanding how mortgage payments are calculated is crucial. A mortgage monthly payment calculator simplifies this for you. Here’s what goes into it:

- Principal Amount – the amount borrowed from the lender

- Interest Rate – cost of borrowing the loan

- Loan Term – number of years to repay the loan

- Extra Payments – optional monthly additions to pay off the mortgage faster

- Taxes and Insurance – property tax and homeowner insurance (varies by country)

Example:

Using a first time buyer mortgage calculator US, if you borrow $300,000 at 6% for 30 years, your monthly payment is approximately $1,798 (excluding taxes and insurance).

A mortgage calculator UK works similarly but factors in UK-specific elements like stamp duty and local insurance rates.

Mortgage Calculator UK vs US

While the principles of mortgage calculation are similar, there are key differences between the US and UK:

| Feature | UK | US |

| Loan term | Typically 25 years | 15-30 years |

| Interest rate | Fixed or tracker | Fixed or variable |

| Taxes | Stamp duty + local council tax | Property tax |

| PMI | Less common | Common if down payment < 20% |

| Extra payments | Prepayments allowed | Prepayments allowed |

Using a mortgage repayment calculator UK or mortgage calculator US, you can quickly see how these differences affect your monthly payment.

Why Use a Free Online Mortgage Calculator?

A free mortgage calculator is not just about numbers; it’s about planning your future. Here’s why it’s essential:

- Estimate affordability: Use a mortgage affordability calculator to see what you can realistically borrow.

- Plan repayments: Track monthly costs with a mortgage monthly payment calculator.

- Compare options: Check multiple rates using a mortgage comparison US tool.

- Plan extra payments: See how additional contributions reduce interest and loan term using a mortgage calculator with extra payments.

- Make informed decisions: Avoid surprises with accurate estimations for taxes, insurance, and total repayments.

Understanding Your Mortgage Breakdown

A good mortgage calculator provides a detailed breakdown of your payments. This is especially helpful if you want to see where your money goes each month:

- Principal: The portion that reduces your loan balance

- Interest: Cost of borrowing

- Taxes: Property taxes (varies by location)

- Insurance: Protects your home and lender

- PMI: Applies if your deposit is less than 20% (mostly US)

Using charts or graphs with your home loan calculator can make this even easier to understand. Visualizing the split between principal and interest helps with long-term planning.

First-Time Buyer Tips

If you are using a first time buyer mortgage calculator US or UK tool:

- Start with a realistic down payment

- Factor in closing costs or stamp duty

- Consider government schemes or incentives

- Always test multiple scenarios, higher deposits, shorter terms, or extra payments

This helps you see the impact of different strategies on your monthly payment and total interest.

Using a Mortgage Calculator With Extra Payments

Making extra payments can save thousands in interest and shorten your mortgage term. A mortgage calculator with extra payments allows you to:

- See how $100/month extra reduces interest

- Compare monthly vs yearly additional payments

- Plan for early payoff without surprises

Even small extra contributions can have a major long-term impact.

How to Compare Mortgages

A mortgage comparison US or UK tool is essential when you want to shop around. Look for calculators that allow you to:

- Enter different interest rates

- Adjust loan terms

- Factor in taxes, insurance, and fees

- Visualize total repayment over time

This ensures you choose the most affordable option for your situation.

Mortgage Affordability Calculator

Affordability is key. A mortgage affordability calculator considers:

- Your income

- Existing debts

- Down payment

- Loan-to-Value (LTV) ratio calculator

This gives a realistic borrowing range, helping you avoid financial stress.

Mortgage Advice UK & US

While calculators are powerful, they should not replace professional advice. Mortgage advice UK and US advisors can help you:

- Understand lender requirements

- Navigate complex mortgage options

- Evaluate long-term financial impact

- Plan for refinancing opportunities

Combine your calculator insights with professional advice for the best outcome.

Best Mortgage Calculator Online

A high-quality calculator should be:

- Free and easy to use

- Accurate and up-to-date

- Able to handle multiple currencies (USD, GBP, EUR)

- Interactive with graphs and breakdowns

- Able to export results for record-keeping

Using a home loan calculator like ours gives you all these features in one place.

FAQs About Mortgage Calculators

1. What is a mortgage payment calculator?

It estimates your monthly payments based on loan amount, term, interest rate, taxes, insurance, and extra payments.

2. How accurate is a mortgage calculator?

It provides estimates. Exact payments depend on lender, fees, and actual interest rate.

3. Can I make early payments?

Yes, extra payments reduce principal faster and lower total interest.

4. What’s the difference between US and UK calculators?

US calculators often include PMI and property tax, while UK calculators consider stamp duty and local insurance.

5. Are online mortgage calculators safe?

Yes, as long as you don’t enter sensitive personal info. They are for estimation only.

Conclusion

A mortgage calculator is an essential tool for anyone buying a home or planning a refinance. Using a free online mortgage calculator, you can:

- Understand monthly payments

- Test scenarios with extra payments

- Compare mortgage options

- Check affordability

- Plan your finances efficiently

Whether you are a first-time buyer in the US or looking for a remortgage in the UK, a mortgage payment calculator can save you time, money, and stress.

Try our advanced mortgage calculator today and take control of your home financing!